STIMULUS SPENDING RECAP

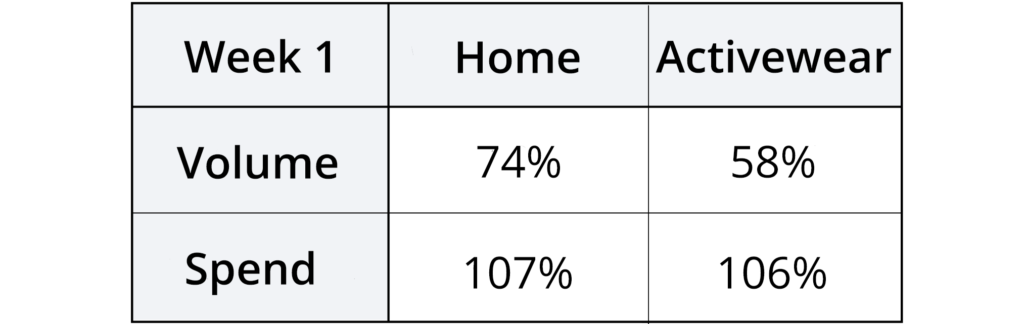

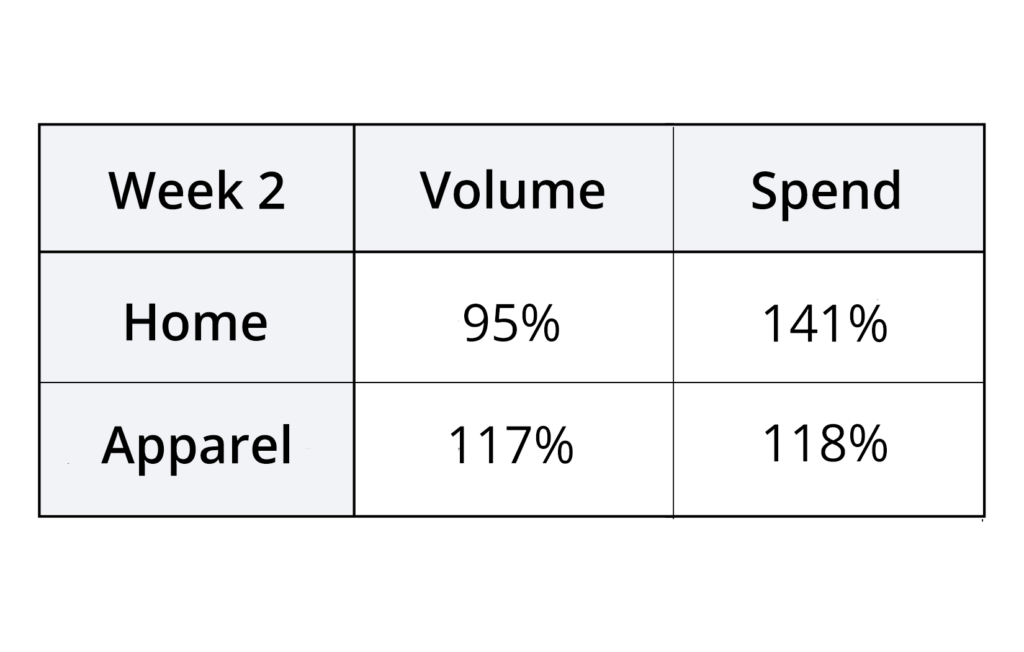

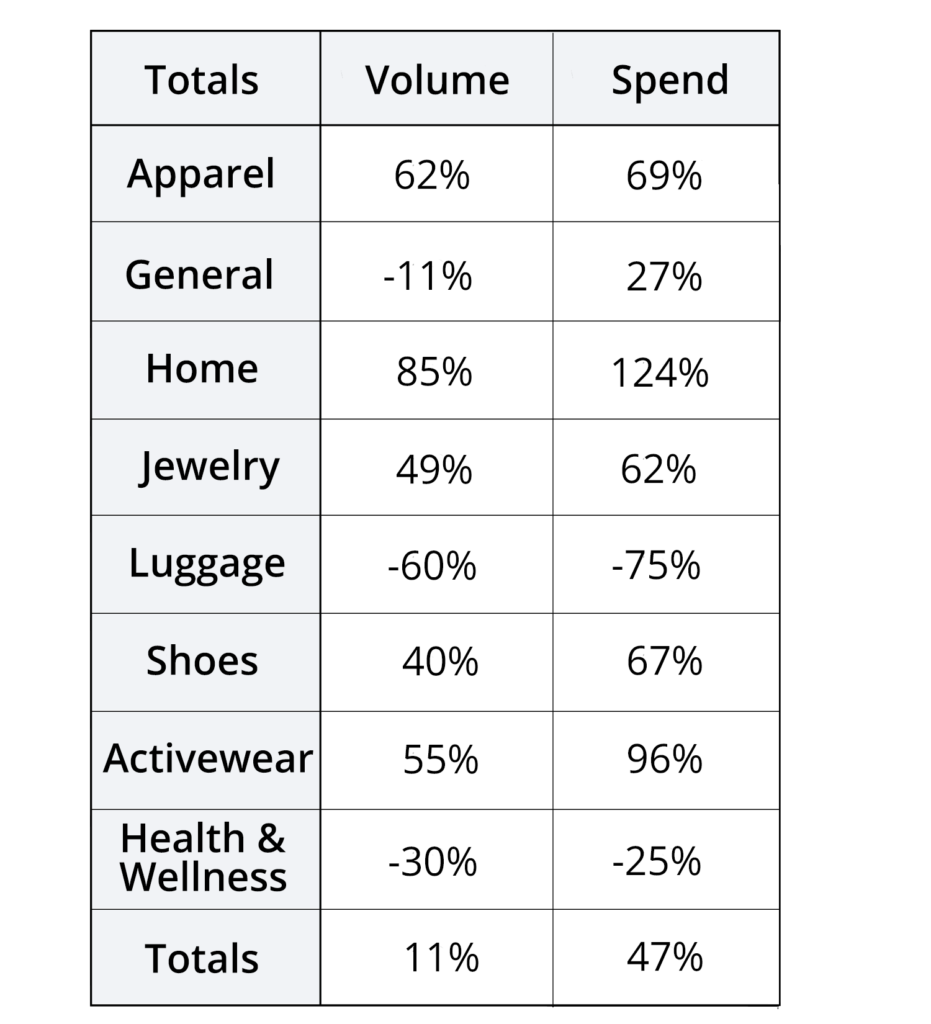

During the past year, we’ve seen some changes in the way consumers spend. From increased AOV and making less purchases in stores, consumer shopping behavior is changing as consumers adjust to the ever-changing normal. The announcement for the second stimulus had many wondering how consumers will spend their dollars as life reopens and the weather warms. We’ve taken a look into the transaction data of retailers to see how, or whether consumers spent these extra dollars.