VALENTINE'S SALES RECAP

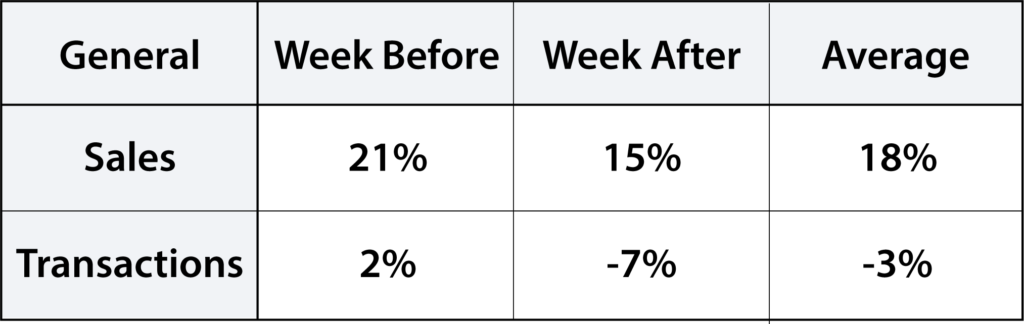

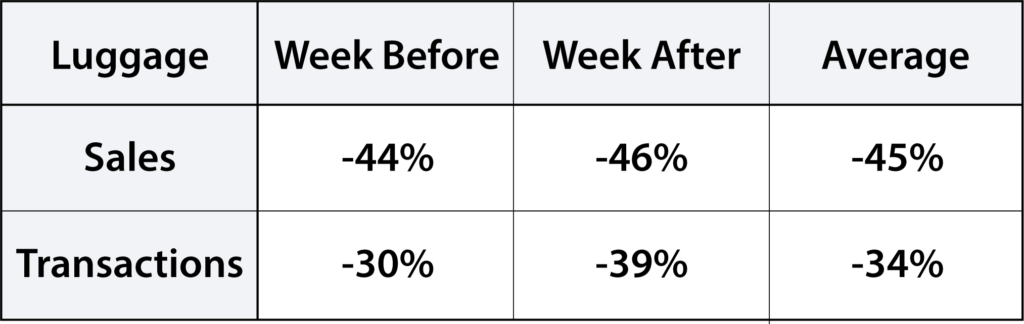

Approaching a year into the pandemic, consumers are adjusting their habits and spending into the new way of living for the time being. Valentine’s Day marks one of the last holidays consumers will be experiencing for the first time under this pandemic, causing questions to come out about how consumer shopping has changed with the experience of the winter holidays under their belts. Performance of Valentine’s Day did not parallel that of December’s, with notable spending habits changing. Read on to see what categories saw growth, decline, and how consumers choose to shop.